Book To Tax Reconciliation Worksheet

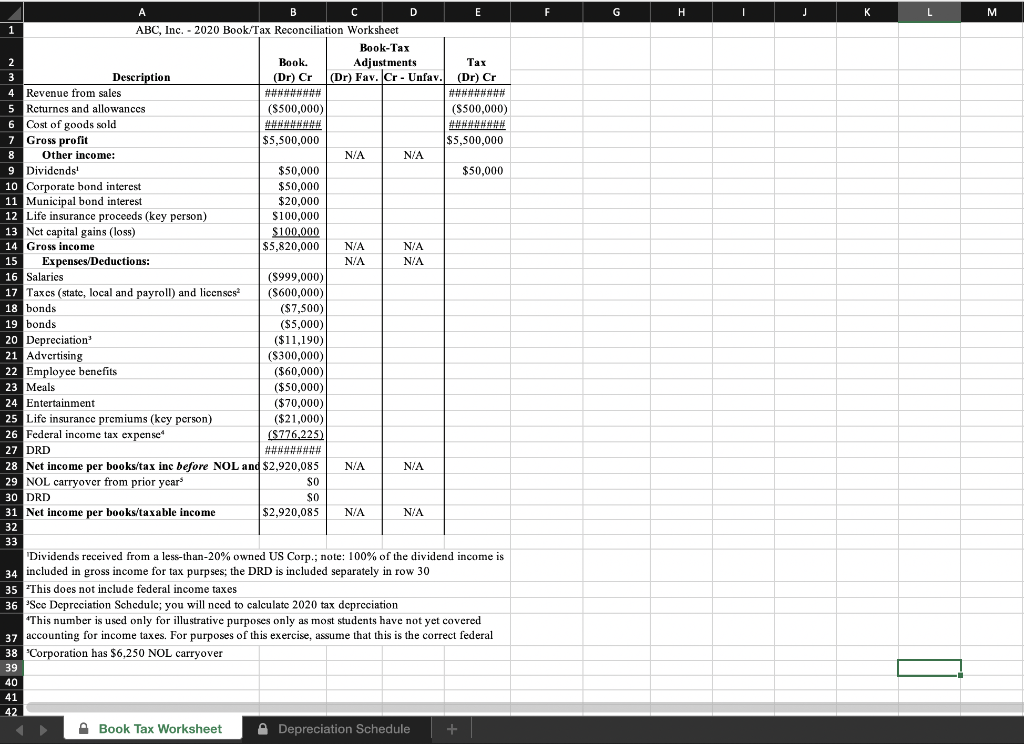

Book To Tax Reconciliation Worksheet - View book tax reconciliation worksheet for c corp tax return problem.xlsx from acct misc at shepherd university. 2016 partnership tax return problem aspen ridge income statement for current Dividends $100,000 municipal bond interest $500,000 corporate bond interest. Differences between revenues and expenses recognized for financial statement purposes and tax return purposes are commonly referred to as book to tax differences and are either permanent or temporary differences. Companies must reconcile the difference between their book income and tax income on their books and tax returns. See the instructions for line 16 for details.

To reconcile your accrual accounting for tax purposes, subtract all accrued expenses and earnings from your year’s earnings. Meals and entertainment repairs and maintenance total expenses effective tax rate reconciliation savings and checking account, king friday bank Income and deductions reported on tax return in accordance with the rules in the i.r.c. To get started, review the provided financial information to determine the book income by calculating gross profit and then adding other income sources like dividends and municipal bond interest. Differences between revenues and expenses recognized for financial statement purposes and tax return purposes are commonly referred to as book to tax differences and are either permanent or temporary differences.

View book to tax reconciliation.xlsx from acc 4401 at brightwood college. This column walks the reader through a discussion of current and deferred tax expense as a bridge to ultimately preparing the rate reconciliation. In an ideal world i would just post an entry and reverse whatever nonsense the bookkeeper decided to edit for prior year. Value creators, llc book.

Use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. Companies often follow the generally accepted accounting principles. Companies must reconcile the difference between their book income and tax income on their books and tax returns. View book tax reconciliation worksheet for c corp tax return problem.xlsx from acct.

(dr) cr $10,000,000 ($500,000) ($4,000,000) $5,500,000 description (dr) cr revenue from sales $10,000,000 returnes and allowances ($500,000) cost of goods sold ($4,000,000) gross profit $5,500,000 other income: View book tax reconciliation worksheet for c corp tax return problem.xlsx from acct misc at shepherd university. Reconciliation of book and taxable income (income and deductions.) Set this money aside and make sure.

Companies must reconcile the difference between their book income and tax income on their books and tax returns. (dr) cr $10,000,000 ($500,000) ($4,000,000) $5,500,000 description (dr) cr revenue from sales $10,000,000 returnes and allowances ($500,000) cost of goods sold ($4,000,000) gross profit $5,500,000 other income: View book to tax reconciliation.xlsx from acc 4401 at brightwood college. This column walks the.

In an ideal world i would just post an entry and reverse whatever nonsense the bookkeeper decided to edit for prior year. View book to tax reconciliation.xlsx from acc 410 at university of nevada, las vegas. Income and deductions reported on tax return in accordance with the rules in the i.r.c. Meals and entertainment repairs and maintenance total expenses effective.

Book To Tax Reconciliation Worksheet - Use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. Set this money aside and make sure your balance matches what you’re reporting on your taxes. View book to tax reconciliation.xlsx from acc 410 at university of nevada, las vegas. See the instructions for line 16 for details. (dr) cr $10,000,000 ($500,000) ($4,000,000) $5,500,000 description (dr) cr revenue from sales $10,000,000 returnes and allowances ($500,000) cost of goods sold ($4,000,000) gross profit $5,500,000 other income: Prima donna llc account name book income (dr) cr permanent temporary (dr)

Companies often follow the generally accepted accounting principles. Income and deductions reported on tax return in accordance with the rules in the i.r.c. View book to tax reconciliation.xlsx from acc 4401 at brightwood college. 2016 partnership tax return problem aspen ridge income statement for current Value creators, llc book to tax reconciliation worksheet year ended december 31, 2021 per.

This Means Going All The Way Back To January And Pulling Out Anything That Was Never Paid.

View book to tax reconciliation.xlsx from acc 4401 at brightwood college. Dividends $100,000 municipal bond interest $500,000 corporate bond interest. See the instructions for line 16 for details. View book tax reconciliation worksheet for c corp tax return problem.xlsx from acct misc at shepherd university.

Companies Often Follow The Generally Accepted Accounting Principles.

Reconciliation of book and taxable income (income and deductions.) Prima donna llc account name book income (dr) cr permanent temporary (dr) View book to tax reconciliation.xlsx from acc 410 at university of nevada, las vegas. Income and deductions reported on tax return in accordance with the rules in the i.r.c.

Use The Qualified Dividends And Capital Gain Tax Worksheet Or The Schedule D Tax Worksheet, Whichever Applies, To Figure Your Tax.

(dr) cr $10,000,000 ($500,000) ($4,000,000) $5,500,000 description (dr) cr revenue from sales $10,000,000 returnes and allowances ($500,000) cost of goods sold ($4,000,000) gross profit $5,500,000 other income: 2016 partnership tax return problem aspen ridge income statement for current This column walks the reader through a discussion of current and deferred tax expense as a bridge to ultimately preparing the rate reconciliation. Book to tax reconciliation worksheet description gross profit dividend

To Get Started, Review The Provided Financial Information To Determine The Book Income By Calculating Gross Profit And Then Adding Other Income Sources Like Dividends And Municipal Bond Interest.

To reconcile your accrual accounting for tax purposes, subtract all accrued expenses and earnings from your year’s earnings. Value creators, llc book to tax reconciliation worksheet year ended december 31, 2021 per. Set this money aside and make sure your balance matches what you’re reporting on your taxes. Financial reporting and tax compliance are two critical aspects of a company’s fiscal responsibilities, each governed by different sets of rules.