Capital Loss Carryover Worksheet 2024

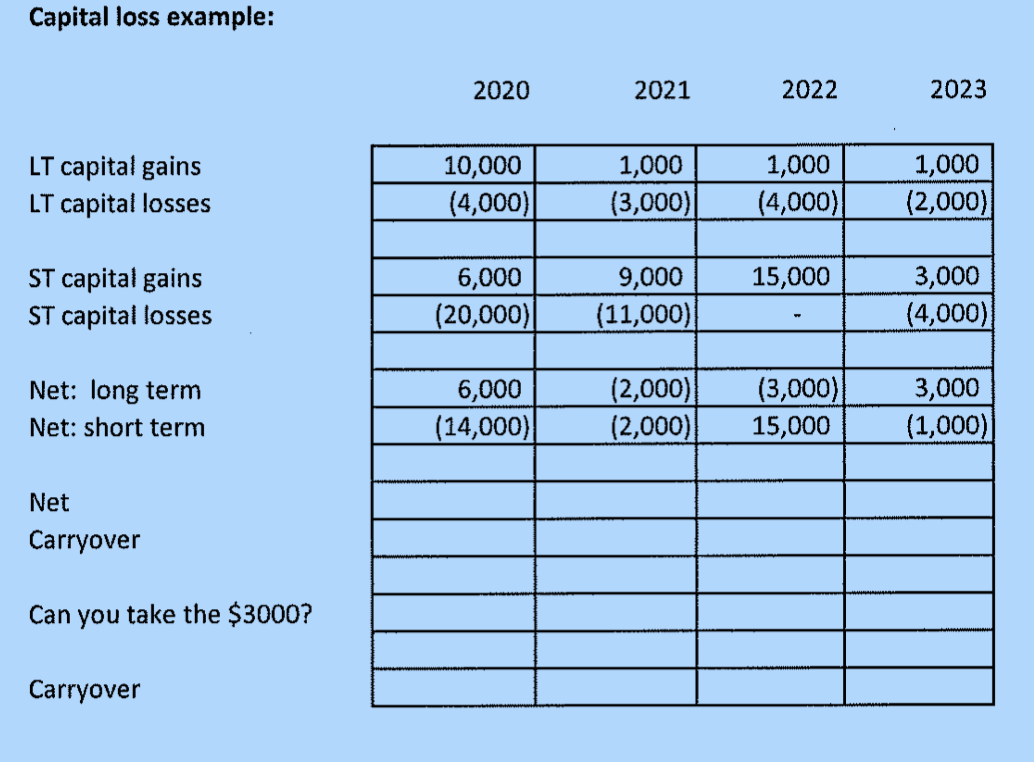

Capital Loss Carryover Worksheet 2024 - The difference between line 16 and 21 is the carryover loss for next year. Use this worksheet to figure your capital loss carryovers from 2023 to 2024 if your 2023 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your 2023 schedule d,. Use this worksheet to figure the estate's or trust's capital loss carryovers from 2024 to 2025 if schedule d, line 20, is a loss and (a) the loss on schedule d, line 19, column (3), is more than. These include schedule d (capital gains and losses) and form 1040 (u.s. We review how it works, maximum limit, carryover, wash sales, & more. One of the topics that many investors and taxpayers are interested in is capital loss carryover.

The difference between line 16 and 21 is the carryover loss for next year. Enter the amount, if any, from line 8 of your capital loss carryover worksheet in the instructions. We review how it works, maximum limit, carryover, wash sales, & more. Capital loss carryover is the amount of capital loss that can be carried forward from. Use this worksheet to figure your capital loss carryovers from 2023 to 2024 if your 2023 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your 2023 schedule d,.

The difference between line 16 and 21 is the carryover loss for next year. Use this worksheet to figure the estate's or trust's capital loss carryovers from 2024 to 2025 if schedule d, line 20, is a loss and (a) the loss on schedule d, line 19, column (3), is more than. We review how it works, maximum limit, carryover,.

Claiming capital loss carryover involves filling out specific tax forms. There is also a carryover worksheet showing the carryover from the prior year and the current. These include schedule d (capital gains and losses) and form 1040 (u.s. We review how it works, maximum limit, carryover, wash sales, & more. The difference between line 16 and 21 is the carryover.

Claiming capital loss carryover involves filling out specific tax forms. When selling investments at a loss, claim a capital loss tax deduction. Enter the amount, if any, from line 8 of your capital loss carryover worksheet in the instructions. Use this worksheet to figure the estate's or trust's capital loss carryovers from 2024 to 2025 if schedule d, line 20,.

The difference between line 16 and 21 is the carryover loss for next year. Claiming capital loss carryover involves filling out specific tax forms. These include schedule d (capital gains and losses) and form 1040 (u.s. Use this worksheet to figure your capital loss carryovers from 2023 to 2024 if your 2023 schedule d, line 21, is a loss and.

There is also a carryover worksheet showing the carryover from the prior year and the current. Use this worksheet to figure the estate's or trust's capital loss carryovers from 2024 to 2025 if schedule d, line 20, is a loss and (a) the loss on schedule d, line 19, column (3), is more than. Use this worksheet to figure your.

Capital Loss Carryover Worksheet 2024 - The difference between line 16 and 21 is the carryover loss for next year. Claiming capital loss carryover involves filling out specific tax forms. There is also a carryover worksheet showing the carryover from the prior year and the current. When selling investments at a loss, claim a capital loss tax deduction. Use this worksheet to figure your capital loss carryovers from 2023 to 2024 if your 2023 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your 2023 schedule d,. These include schedule d (capital gains and losses) and form 1040 (u.s.

Use this worksheet to figure the estate's or trust's capital loss carryovers from 2024 to 2025 if schedule d, line 20, is a loss and (a) the loss on schedule d, line 19, column (3), is more than. Use this worksheet to figure your capital loss carryovers from 2023 to 2024 if your 2023 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your 2023 schedule d,. When selling investments at a loss, claim a capital loss tax deduction. We review how it works, maximum limit, carryover, wash sales, & more. There is also a carryover worksheet showing the carryover from the prior year and the current.

There Is Also A Carryover Worksheet Showing The Carryover From The Prior Year And The Current.

Enter the amount, if any, from line 8 of your capital loss carryover worksheet in the instructions. The difference between line 16 and 21 is the carryover loss for next year. Use this worksheet to figure your capital loss carryovers from 2023 to 2024 if your 2023 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your 2023 schedule d,. Use this worksheet to figure the estate's or trust's capital loss carryovers from 2024 to 2025 if schedule d, line 20, is a loss and (a) the loss on schedule d, line 19, column (3), is more than.

Claiming Capital Loss Carryover Involves Filling Out Specific Tax Forms.

These include schedule d (capital gains and losses) and form 1040 (u.s. Capital loss carryover is the amount of capital loss that can be carried forward from. One of the topics that many investors and taxpayers are interested in is capital loss carryover. When selling investments at a loss, claim a capital loss tax deduction.